The following analysis is based on quarterly commercial resale data and serves as a broad barometer of overall commercial real estate market performance in Grey and Bruce Counties. The data reflect all commercial property transactions reported through the REALM system.

Commercial sales activity in this region has historically been volatile, largely due to the influence of a limited number of high-value transactions in any given quarter. These large sales can cause sharp swings in aggregate sales volume ($) even when the overall number of transactions remains relatively stable. For this reason, both metrics—volume and transaction count—are important in assessing market performance.

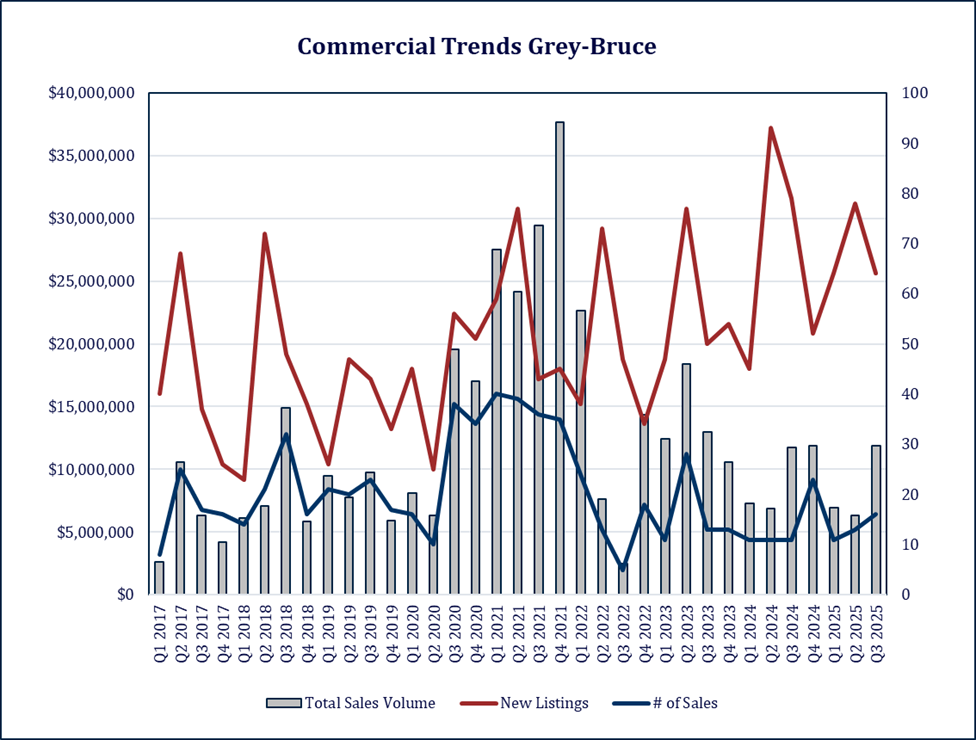

The chart illustrates a period of steady but moderate market activity from 2017 through 2019, marked by consistent but unspectacular sales volume and transaction counts. Beginning in 2020, coinciding with the onset of the COVID-19 pandemic, the market experienced a period of strong growth. Supported by record-low interest rates, increased investor appetite for regional assets, and a surge in capital seeking yield outside of major metropolitan centres, both the number of sales and aggregate sales volume rose significantly, with activity peaking in late 2021 and early 2022.

The Bank of Canada’s rapid series of interest-rate hikes beginning in March 2022 marked a turning point. Higher borrowing costs, combined with rising economic uncertainty, led to a sharp slowdown in investment activity. Both the number of sales and aggregate sales volume declined through the latter half of 2022 and into 2023, as access to affordable capital tightened and buyer sentiment cooled.

As shown in the most recent data, 2024 and early 2025 saw sales activity stabilize at lower but more sustainable levels, with volumes comparable to those observed in the pre-pandemic years of 2017–2019. Transaction counts have also remained relatively subdued, underscoring that the slowdown reflects a broader reduction in investor demand rather than merely the absence of a few large institutional transactions.

Overall, the data highlight the sensitivity of the regional commercial real estate market to interest-rate conditions and capital costs. Periods of easy credit and low rates have historically spurred higher levels of sales activity and transaction volumes, while periods of rising rates have dampened both demand and pricing power. The most recent trends suggest the market is in a post-pandemic adjustment phase, with investors and sellers recalibrating expectations in response to a higher-rate environment.