The preceding data is derived from publicly reported transactions and listings and is intended to serve as a general indicator of overall commercial market activity. The dataset includes all commercial and multi-residential property sales and listings throughout Grey and Bruce Counties that were marketed through the ITSO Multiple Listing Service (MLS). As such, the information should be interpreted as a broad market barometer rather than a precise measure of value trends for any single property type or submarket.

Commercial MLS statistics are inherently volatile and can fluctuate materially from period to period, particularly due to the presence or absence of one or more high-value transactions in a given quarter. As a result, changes in total dollar volume do not necessarily reflect proportional changes in pricing or underlying demand. Notwithstanding these limitations, the data does provide useful perspective on relative market momentum and transactional activity. Based on the above statistics, we note the following:

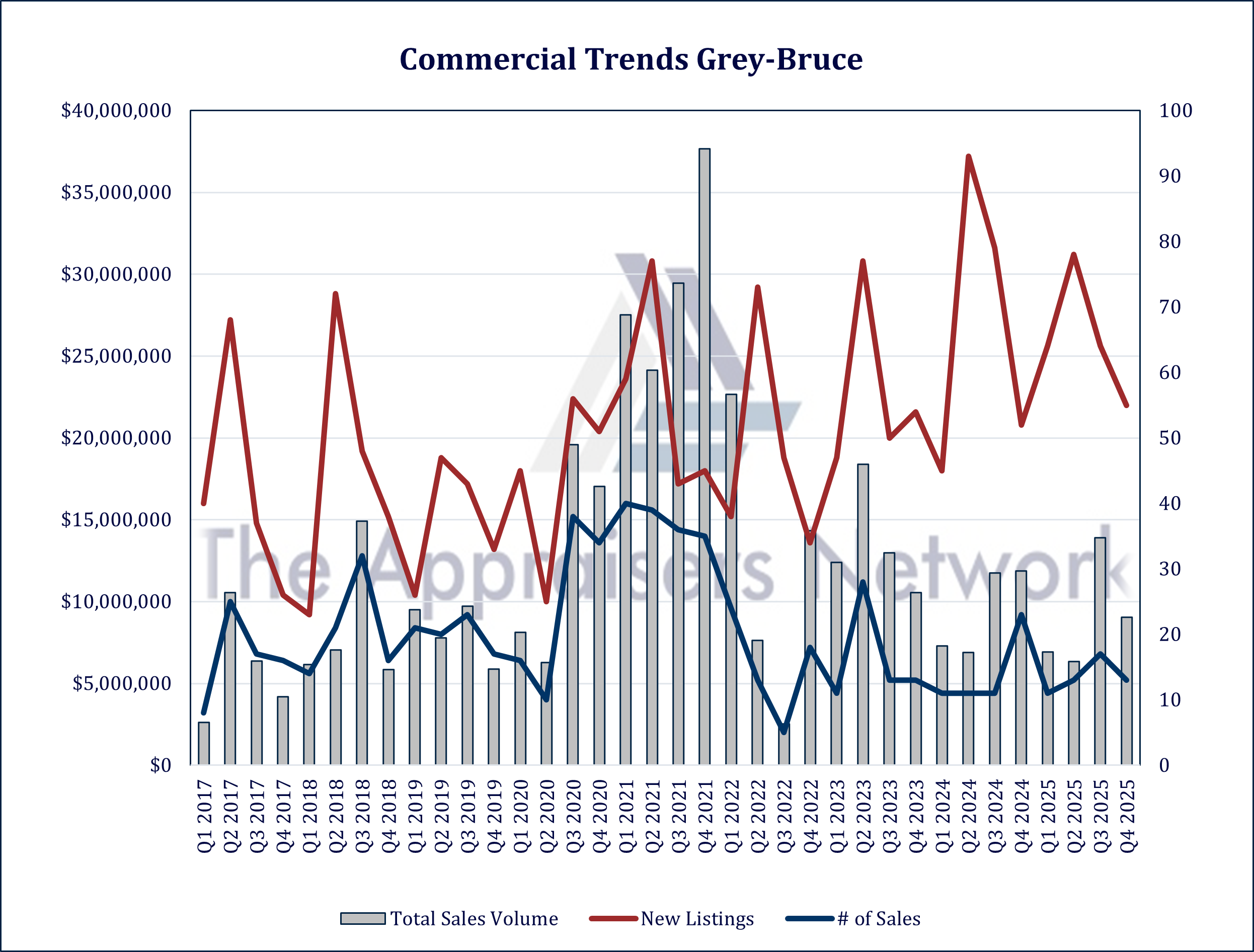

- Total Sales Volume ($) decreased by 35.0% on a quarter-over-quarter basis and decreased by 4.3% on a year-over-year basis, largely influenced by the timing and scale of larger asset transactions.

- Active Listings decreased by 14.1% quarter-over-quarter and decreased by 3.0% year-over-year, suggesting a tightening or loosening of available inventory within the commercial and multi-residential market.

- Number of Sales decreased by 23.5% quarter-over-quarter and decreased by 3.6% year-over-year, providing a clearer indication of transactional velocity and buyer engagement than dollar volume alone.

Taken together, these indicators suggest that the market is in a moderating phase. Sales activity has remained relatively muted, while active listings have continued to trend at elevated levels. This imbalance indicates that supply currently exceeds near-term demand, contributing to longer marketing periods and increased competition among sellers. Pricing appears to be stabilizing, with transaction outcomes increasingly influenced by asset quality, location, and income durability rather than broad market momentum.